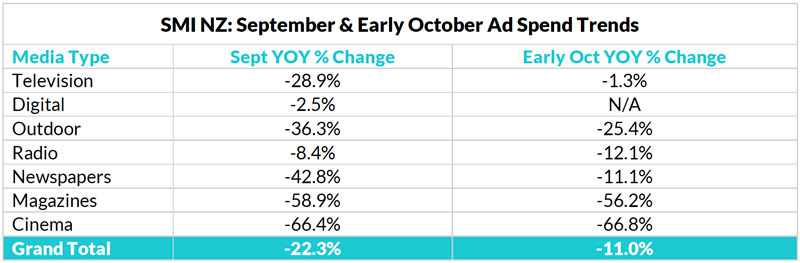

AUCKLAND, Tuesday: NZ’s media industry has reported a larger decline in adspend in September – but only due to the prior year featuring abnormally high Rugby World Cup ad revenues – with the market improvement already continuing in October, according to SMI.

Total national marketer ad pend fell 22.3% in September from last year’s record RWC-inspired levels with the Digital (-2.5%) and Radio (-8.4%) media reporting by far the lowest declines.

The abnormal prior year spend interrupted four consecutive months of lower post-Covid improvements in adspend, but the trend has restarted in October with the early SMI data showing ad demand in that month back only 11%.

SMI AU/NZ MD Jane Ractliffe said: “Ogoing increases in Government category advertising in the pre-election period has underpinned the NZ market, with Government category bookings up 47% in September, bringing the September quarter growth to 59%.

“And in the election month of October, we can see Government adspend is already 59% higher with each of the TV and Radio media doubling the value of their Government category bookings in the month.

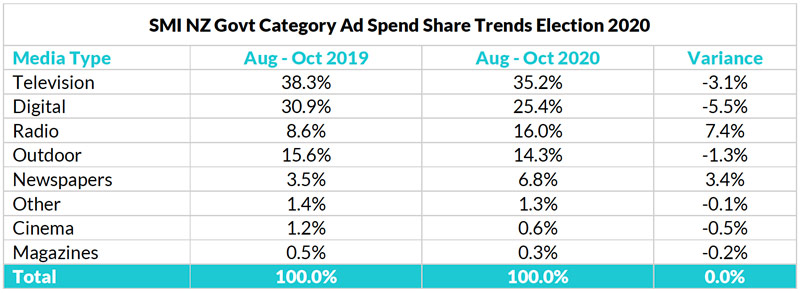

“But over the three months leading up to the national election we can see that Radio and Newspapers gained the greatest increase in the Government category’s overall share, taking spend from the TV and Digital media.’’

“Over the three months leading up to the election we can see that Radio & Newspapers gained the greatest increase in the Government category’s overall share, taking spend from the TV and Digital media.’’

“Apart from stronger Government category ad spend in October, Television’s early strength has also come from higher media investment from the Food/Produce/Dairy, Pet Food and Quick Service Restaurant categories.

“SMI’s Forward Pacings data also shows the renewed advertising demand to be continuing, with the value of advertising booked in November no equal to 72% of last November’s total, bringing the forwards back to levels we would normally see at this point of the cycle prior to Covid.

“And already we can some key product categories delivering higher media investment in November, with the Food/Produce/Dairy category leading the market with growth of 7.7%, while Non Alcoholic Beverage adspend is already 5.5% higher in November than the same month a year ago and Insurance advertising has lifted 0.5%.

“And in December SMI can already see just over half the value of last December’s total adspend has already been booked, which is a higher level of forward bookings than would normally be expected.

“But given the timing-affected September 2020 revenues the decline in September quarter ad demand in NZ has hit 20.1% and so far for the nine months of this year the market is back 18.9%.”

About Standard Media Index

SMI was established in 2009 in Sydney and has offices in New York, London and Madrid. SMI partners with leading global media buying agencies to provide independent, accurate and timely advertising expenditure data to its clients to facilitate informed analysis of the media sector and product category expenditure. Data is sourced directly from advertising agencies’ billing systems and then aggregated to show the combined picture of media Agency ad spend across all major media, media sectors, 40 product categories and 140 sub categories. It allows subscribers to monitor and analyse key data points that can be actioned to grow share and make better investment decisions. SMI provides the only clear picture on how ad dollars are being spent. SMI works with media agencies in more than 15 global markets.

Share this Post

The post RWC hit ad demand appeared first on M+AD!.

More Stories

GroupM agencies earn GenderTick accreditation in New Zealand

Doordash Jumps on the Dance Ad Trend, but Makes it ‘Cinematically Weird’

Big and little buddies pay it forward