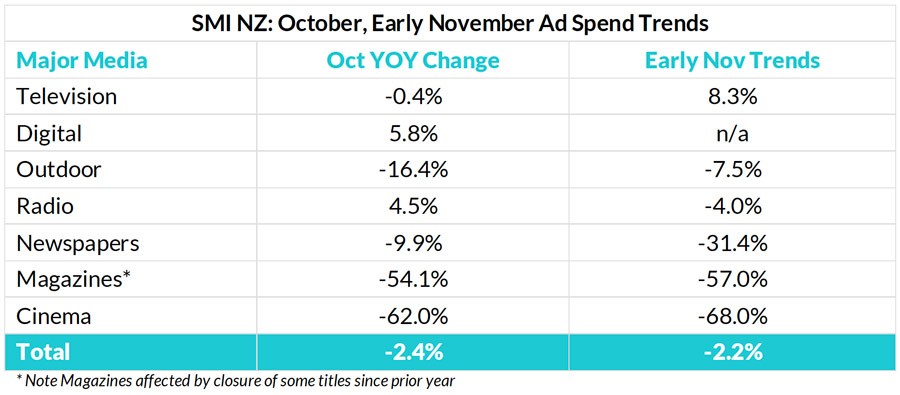

AUCKLAND, Today: NZ’s media sector looks set to cautiously emerge from the Covid slump, and is well positioned to report its first month of growth since March, with early SMI data for the month showing total market demand so far back just 2.2% with that data collected with another week of trading still to occur.

SMI AU/NZ MD Jane Ractliffe said: “The good news follows a strong October result with the lowest decline in national marketer adspend since the pandemic began in March with the value of total bookings back just 2.4%, driven largely by a 94% year-on-year increase in Government Category adspend, given this was the month of the national election.”

The stronger October results also reduce the market’s decline over the financial year to 15.1%, with that period’s adspend impacted by an abnormal September month, given the prior year featured the extra Rugby World Cup-related ad revenues.

Ractliffe said the latest SMI data proved the New Zealand advertising market was now moving quickly out of the slump with both the digital and radio media reporting strong October results, and TV remaining stable.

“After such a horrid six months it’s very encouraging to see the NZ media market return to a level of normality.”

“After such a horrid six months it’s very encouraging to see the NZ media market return to a level of normality in October and to now be reporting much stronger increases in future activity,” she said.

“It’s very likely adspend will be positive in November and SMI’s Forward Pacings data – which measures confirmed future adspend – shows 80% of the value of the December 2019 ad market has already been confirmed, and the month has only just begun.”

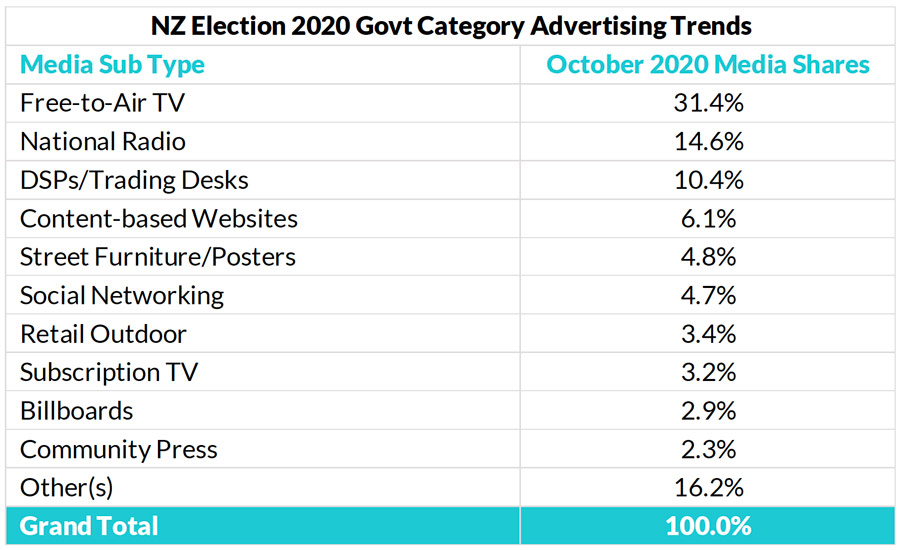

In relation to election adspend trends, Ractliffe said the broadcast TV and radio media were the key media used for messaging, but social networks, retail outdoor and premium websites were also utilised.

“Radio was one of the largest beneficiaries of the increased Government category adspend in October, reporting the largest share increase of any major media with a 6.6 percentage point increase in Government category adspend to take 16.1% of all Government adspend that month,” she said.

“Television’s share of this category also grew to 34.6% (mostly all going to free-to-air TV) and newspapers also grew their Government category spend by four percentage point to be 6.9% of all Government adspend during the election.

“Radio was one of the largest beneficiaries of the increased Government category adspend in October.”

“The digital media’s share of Government spending actually decreased in October, but strong growth from other categories ensured its total bookings lifted 5.8% from October 2019.

“Key trends evident in the NZ digital media advertising include a trebling of ad spending to social media websites such as Facebook and Snapchat and a surge in bookings to the premium content websites market [+87% YOY].

“While the increase in Government category adspend was a key feature of this month’s data SMI also reported large increases in food/produce/dairy [+17%] and consumer electronics [+84%] adspend.

“And calendar year-to-date results for NZ show total agency spend down 17% with digital reporting with the lowest decline of 9.7% followed by radio with a drop of 9.8%.”

About Standard Media Index

SMI was established in 2009 in Sydney and has offices in New York, London and Madrid. SMI partners with leading global media buying agencies to provide independent, accurate and timely advertising expenditure data to its clients to facilitate informed analysis of the media sector and product category expenditure. Data is sourced directly from advertising agencies’ billing systems and then aggregated to show the combined picture of media agency adspend across all major media, media sectors, 40 product categories and 140 sub categories. It allows subscribers to monitor and analyse key data points that can be actioned to grow share and make better investment decisions.

Share this Post

The post The Recovery? appeared first on M+AD!.

More Stories

MNTN Is Selling Ryan Reynolds’ Agency Maximum Effort, SEC Filing Shows

Former KADN Anchor Taylor Trache to Join KLFY in Louisiana

Disney and Hulu Respond After Oscars Streaming Glitches Affect Viewers