Out-of-home (OOH) advertising is the only traditional media that’s still showing growth, but some advertisers are holding back, because the process of buying billboards and transit ads is like wrangling cats.

To try and get more advertisers on board, AdQuick, a startup backed by Reddit co-founder Alexis Ohanian, is creating an online marketplace for buying and selling outdoor inventory. Starting Monday, the Los Angeles-based company is making its OOH planning and optimization technology, called Campaign Genius, available as a stand-alone product.

The digital out-of-home market is hot. Netflix is buying billboard displays and AdQuick competitors like Broadsign are getting acquisitive.

“Outdoor advertising has always been an important element of the marketing mix, but it required a lot of time and dealing with multiple vendors over calls and emails to execute a campaign,” said Ohanian, now a managing partner at early-stage VC firm Initialized Capital and a member of AdQuick’s board.

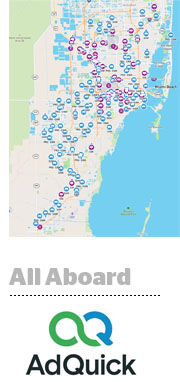

AdQuick doesn’t own out-of-home inventory, but rather aggregates it at scale through partnerships with billboard suppliers across the country. Brands indicate their KPIs, timing, budget, points of interest and the demographics of the ideal neighborhood they’re looking to target, and Campaign Genius finds look-alike audiences in the most affordable markets based on those constraints. Advertisers can also place buys through the platform.

There are more than 1,000 OOH media owners in the United States alone – and even the largest media owners in the Unites States only have 15% of inventory – which may sound daunting from a planning perspective, but actually presents an opportunity for “geographically open minded brands,” said Matthew O’Connor, CEO and co-founder of AdQuick.

There’s no point tapping out your test budget in a crowded market like San Francisco – where the chance of gaining share of voice is minimal – if you can also reach your target demo in a suburb of Dallas or Denver, he said.

Neighborhood-focused social network Nextdoor is starting to experiment with outdoor and looking at markets beyond major metro areas after initially being quite skeptical of the medium, said Dan Laufer, Nextdoor’s director of growth and partnerships.

The biggest barriers were finding the best markets, getting visibility into placements – aka, ensuring that all the billboards they want to buy are well situated so that people can actually see them – and, ultimately, being able to measure results.

The biggest barriers were finding the best markets, getting visibility into placements – aka, ensuring that all the billboards they want to buy are well situated so that people can actually see them – and, ultimately, being able to measure results.

Nextdoor recently hooked up with AdQuick to plan a four-week test campaign with outdoor elements launching on Monday in St. Louis, a drive-time market with lower CPMs. St. Louis is also fairly reflective of other markets across the United States, which makes it good for an initial test, Laufer said. And, in addition to creating its outdoor media plan, Nextdoor used a feature within the AdQuick platform to get a real-world view of locations before placing its buys.

Although it’s technically possible to get CPM efficiency in a larger market like New York, for example, “you couldn’t get the saturation or the reach and frequency there that you could get in a market like St. Louis, and it’s not going to teach you anything about the sort of impact you could have everywhere else,” Laufer said.

But the ability to measure outcomes was the real sweetener.

“My perception until now – and out-of-home’s reputation – has been that it’s not typically performance focused,” Laufer said. “We care deeply about performance, and out-of-home isn’t a particularly cheap channel if you want to scale it, so you really need conviction that it’s going to drive results.”

AdQuick’s approach to measurement falls into three primary buckets: direct attribution through DR elements within the ad creative; integrations with Google Analytics, the Google Ads API and social network APIs to measure the halo effect of outdoor on online engagement; and using aggregated geo data like Wi-Fi signals and Bluetooth to determine increases in foot traffic to particular locations.

But none of the tactics teach if there isn’t a smart media plan in place.

“Brands that try to work with media owners directly often have trouble measuring results, so they abandon the channel for digital, where they can get tighter feedback loops,” O’Connor said. “We’ve talked to numerous brands that threw in the towel for a period of time after experiencing false negatives.”

This post was syndicated from Ad Exchanger.

More Stories

Sinclair SVP of Station Operations to Retire in June

Netflix Sets Up Killer You Marketing Activation With Penn Badgley

5 Ways Brands Can Weather a Tariff Storm as Consumer Spending Shifts Toward Value