Six-year-old women’s underwear brand ThirdLove considers data critical to its whole business, not just its marketing plan.

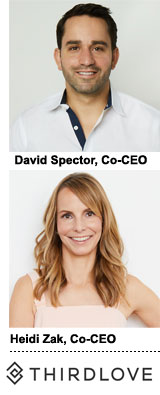

The direct-to-consumer company was founded by husband-and-wife team Heidi Zak and David Spector, who both hail from Google’s advertising business.

“The biggest thing I learned [at Google] was about testing and optimization,” Zak said. “Even if something didn’t work years ago, we’ll test again. Your environment is always changing, the company is changing and platforms are changing.”

ThirdLove’s data-driven approach includes both structured data about what lingerie sizes they buy and unstructured feedback and suggestions.

“Fit algorithms” make sure the DTC bra company’s products match a customer’s unique measurements when they show up on her doorstep. Customer feedback informs product and marketing decisions, such as the range of sizes ThirdLove stocks and what models appears in ads (which it buys programmatically in house).

Both product decisions and ad creative skew inclusive. ThirdLove stocks twice as many sizes as Victoria’s Secret, and its models are more in the vein of Dove “Real Beauty” than Victoria’s Secret Angels.

ThirdLove dynamically updates its ad creative and website product listings to make sure when a customer shops, she sees her body type represented in ads and product listings. If a customer clicks on an ad featuring an older model, for example, she might see more older women modeling products when she browses the site.

It can be expensive to shoot so many models and create multiple versions of ads, and challenging to match the right image to the right customer.

Showing a customer how a bra looks on her body is a critical part of ThirdLove’s business: “Having so many model sizes is expensive, but something we deem so important for the creative, the brand and a factor in being effective,” Zak said.

Their backgrounds at an advertising company may be another reason why the CEOs feel strongly about doing all their digital media buying in house.

“We will never outsource bidding,” Spector said. “It’s a core competency of the company.”

ThirdLove uses an agency for TV media buying and another for content creation, but may eventually bring the content creation in house as well. “The goal is to always have marketing in house, and to bring even more of it in house,” Spector said. ThirdLove uses a TV agency to buy media, and leans on another for content creation at the moment, but never outsources buying.

ThirdLove spent $13.2 million on TV advertising last year, according to Nielsen data. Its approach is to initiate creative in OTT streaming providers, where it can test more versions of an ad, and ads are more targetable and measurable. Those results then inform its linear buys.

“The big difference with OTT is that you are able to test a lot of different ad formats quickly, and you are also able to target,” Spector said.

Adding TV means re-evaluating the credit ThirdLove gives other channels.

“Facebook gets much, much more credit for sales than it deserves,” Spector said – and untangling multitouch attribution poses a challenge even for a data-driven, direct-to-consumer brand.

One reason why ThirdLove is doing more TV advertising is because it’s getting so big. Though it declines to share sales data (Forbes’ $160 million is just an estimate), it employs 400 people.

ThirdLove’s growth attracted sniping from the category’s market share leader, the Victoria’s Secret CMO, who trashed its inclusive marketing in a November 2018 interview where he said that no one would watch plus-size or transsexual models in a fashion show, leading to a huge PR win for ThirdLove when it responded with an full-page ad open letter in The New York Times.

Raising just $30 million to date was a choice, Spector said.

“We are one of the most capital-efficient companies out there,” Spector said. “Having a sustainable brand that could stand on its own two feet was very important to us.”

But ThirdLove just added another investor. Tim Armstrong, Spector’s former boss at Google, recently bought a minority stake in the startup as part of his new venture, the dtx company.

“He’s been a friend and mentor to me over the years, and he reached out after he left Verizon and asked about what we’ve built and if he could invest,” Spector said of the partnership. Plans for how ThirdLove will work with its new minority investor are still being worked out.

As venture backers like the dtx company spring up to invest in a legion of new direct-to-consumer brands, the barrier to entry will continue to fall for these young companies. Many of them are using Facebook as a marketing fertilizer and data as a greenhouse, growing quickly and taking market share from retail-focused companies.

ThirdLove is confident of its position in the market. Once it helps customers find a good bra fit, they keep coming back, giving the brand high repeat rates, according to Spector. While hundreds of mattress companies are competing for market share, ThirdLove faces a single incumbent Goliath. Victoria’s Secret captures 40% of total market share in the bra and underwear category, Zak estimated.

“We have the first mover advantage, and scale where others don’t,” Zak said. “Certainly not everyone will survive, but there is more room in our category than others.”

This post was syndicated from Ad Exchanger.

More Stories

Special PR expands team with two senior hires

Bumble Speaks to ‘Exhausted’ Women With Brand Refresh and Global Campaign

TTD Is All Systems Ro’; Insta Takes Another TikTok Tactic