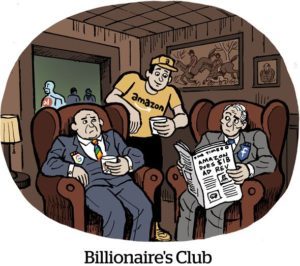

Amazon reported slower than usual revenue growth in its earnings report, with overall sales of $59.7 billion in Q1 2019, a 17% increase compared to the year before.

Amazon reported slower than usual revenue growth in its earnings report, with overall sales of $59.7 billion in Q1 2019, a 17% increase compared to the year before.

Amazon’s annual growth rate dropped, but it is more profitable and its business has a higher profit margin than ever. The company’s operating profit reached $4.4 billion this quarter, compared to $1.9 billion in Q1 2018. Its profit margin jumped from 3.8% to 7.4%.

Amazon’s “Other” business group, which is primarily advertising, recorded $2.7 billion in sales this quarter, up 34% from Q1 2018. That’s a relatively lackluster showing, considering the Other unit has posted 60% annual growth rates every quarter since 2017.

On its earnings call with investors, Amazon CFO Brian Olsavsky said the advertising business enjoyed a higher annual growth rate than the Other group as a whole, though he didn’t break out numbers beyond the category growth rate.

The Amazon Advertising Platform (AAP) has many tempting growth areas, including an off-platform ad network, ramped-up TV and video supply or CPG and grocery delivery. But Olsavsky said the priority is on platform basics.

“Our focus is on adding more functionality, more products and reporting for businesses and advertisers,” he told one investor, who asked about a potential slowdown for the ad business. “Right now it’s more about the tools, making better recommendations and making the demand-side platform easier to use.”

Returning to more than 60% annual growth rates, however, may not be in the cards for AAP as the law of large numbers takes hold. Similar to Google and Facebook, Amazon’s ad revenue is now so large that relatively low growth rates can still represent significant growth.

This post was syndicated from Ad Exchanger.

More Stories

WBD Introduces Out-of-Home Member Plan as It Begins Max Password Crackdown

Deep Blue Is Building a Women’s Sports Yacht Club at Cannes

Sinclair SVP of Station Operations to Retire in June