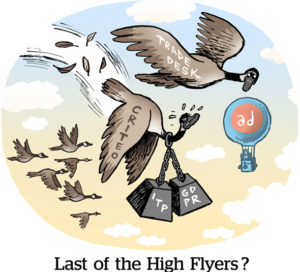

Criteo brought in $670 million in Q4 2018, beating expectations but still 1% below its revenue from the year before, the French ad tech leader reported Tuesday.

Criteo brought in $670 million in Q4 2018, beating expectations but still 1% below its revenue from the year before, the French ad tech leader reported Tuesday.

Criteo’s earnings for the year were flat at about $2.3 billion. But CFO Benoît Fouilland said the stability is a positive sign, considering Criteo was coming out of more severe revenue drop-offs in its previous 2018 disclosures.

“The quarter clearly marked an inflection point since the third quarter when we saw negative growth,” he told AdExchanger.

Fouilland said the Q4 improvements were driven by stronger holiday sales, with “Black Friday” and “Cyber Monday” becoming part of the global retail vocabulary, and growth of Criteo’s non-retargeting products, which accounted for 13% of the total business. The company’s “new solutions” include a prospecting product, CRM data onboarding, HookLogic’s retail and shopper marketing business and a mobile app-install service.

Criteo is racing to bolster its new solutions because retargeting is diminishing, largely due to wireless companies and browser operators taking stronger stances against tracking users and targeting ads. For instance, Safari’s ITP policy is particularly challenging for retargeting vendors.

When Criteo first broke out the non-retargeting revenue in 2017, the company set a goal to grow to 30% of overall business in three years. The new solutions grew from 9% of revenue at the end of 2017 to 13% last quarter. “We realize we have a long way to go. But as of today, those different product lines are showing very solid velocity,” CEO JB Rudelle told an investor.

Rudelle doesn’t believe other browsers like Google Chrome, which controls about two-thirds of the browser market, will enforce ITP-like policies.

“Google is under a high level of scrutiny regarding their business practices, both in the United States and in Europe,” he said. “Given all of this, and although we cannot guarantee, of course, we believe it’s highly unlikely that Google will take advantage of its control over Chrome to restrict the ability of other digital advertising players.”

And if browser restrictions of data and advertising are limited to Safari, then the retargeting business should be stable enough to support the slow growth of Criteo’s newer products.

The company also has $364 million in cash on hand, $50 million less than the end of 2017, but still enough to weather tough times, or a regulatory fine. Criteo shares jumped 10% after its earnings report, so investors at least are comforted that Criteo stemmed its losses in 2018 and will grow out of its retargeting roots.

Criteo faced immense scrutiny last year over GDPR implementation and mobile browser policies, but has emerged healthy, Fouilland said, though not entirely unscathed. “Our business has demonstrated its strong resilience despite heavy headwinds.”

This post was syndicated from Ad Exchanger.

More Stories

Marketing Morsels: Hidden Valley Ranch, La-Z-Boy, Topps & More

Flashback: Jane Pauley and Deborah Norville Revisit Today’s 1989 Succession Drama

Ally Financial Revives ‘Banksgiving’ With A TikTok Twist