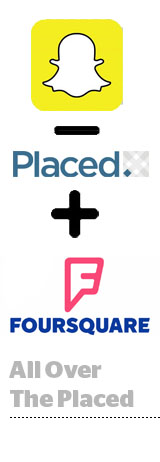

Placed has found a new home.

Foursquare is buying the location-based measurement company from Snap. Separately, it raised $150 million in fresh funding courtesy of The Raine Group, some of which is going to fund the acquisition. The rest is earmarked for R&D.

The deal, announced early Friday morning, comes less than two years after Snap acquired Placed, and represents Foursquare’s first acquisition. Terms were not disclosed, but Placed founder and CEO David Shim is joining Foursquare as president.

Perhaps Foursquare will get more out of Placed’s opt-in user panel and publisher network than Snap did.

After Snap first bought the company in 2017, it looked like Snapchat was about to get serious about attribution, but Placed continued to operate as a separate entity. The teams didn’t mix and Placed maintained its own office.

There were lots of hypotheses flying around for why Snap bought Placed: perhaps to gain better insight into how its audience behaves across platforms or to help attribute retail foot traffic back to Snap ads using the Placed panel.

However, six months after their hookup, in November 2017, Shim told AdExchanger that Placed would not be sharing any advertiser or partner data with Snap. “Keeping the data separate is important if we’re going to have a clean story to go to market and talk about our company,” he said at the time.

Which again begs the question, why did Snap feel the need to acquire Placed outright, rather than simply execute a partnership?

In a chat on Friday, Shim said that Snap acquired his company in order to incubate it and help create a “currency” for omnichannel measurement. Although Placed had momentum in 2017, he said, it was Snap’s investment that allowed the company to really shore up its product suite and platform. “We wouldn’t be where we are today if it was not for Snap,” Shim said.

Foursquare CEO Jeff Glueck tells AdExchanger that Foursquare approached Snap in January with the idea of acquiring Placed, because Foursquare would be able to grow the company even faster by returning it to its roots as an independent location-focused player outside of any of the major media companies.

“Both David and the Snap team spent time with us and came to see the power in the combination,” Glueck said. “It was entirely the Placed team’s choice.”

But it’s also possible that Snap did intend to take better advantage of the Placed technology when other developments intervened.

At the time of the Placed acquisition, Snap’s ad chief was Imran Khan, who has since left the company, as have other high-level execs. And, earlier this year, Snap changed its sales strategy to focus on verticalization and growing brand engagements around premium content.

On top of all that, perhaps the optics of buying a location tracking company eventually made Snap execs balk.

This wouldn’t be the first time that one company bought another with lofty goals in mind, only to lose its appetite down the line. That’s what happened with Verizon, Oath and the promise of subscriber data – albeit on a much larger scale.

But as Placed’s new parent company, Foursquare doesn’t have that problem, in large part because its marketer-focused business is clearly aligned with that of Placed.

And Foursquare has been in the process of executing a multiyear pivot from its roots as a location-centric social network to an attribution and analytics provider for marketers.

Buying Placed – a longtime competitor of Foursquare – helps accelerate Foursquare in its mission to create a complete toolkit of location-aware services, including an SDK for developers, analytics, audience data, attribution and consumer-facing apps.

Going forward, Foursquare’s attribution product will be called “Placed powered by Foursquare,” and the souped-up solution will get access to Foursquare’s Pilgrim SDK and its first-party data. Placed will also be able to use Foursquare’s global map of 105 million global points of interest and Foursquare’s US audience of more than 100 million monthly devices.

And Placed brings a consumer panel that has generated more than 135 million survey responses.

Adding Foursquare’s data, including check-ins and authenticated location data, enhances that truth set, the company claims, by more than 13 billion consumer confirmations. The first-party approach is “unique” to Placed and Foursquare, which raises the bar in an industry “where inaccurate geofencing and junk source data have been all too common,” Glueck wrote in a blog post announcing the deal.

Placed will continue to be a Snap-preferred attribution partner to help Snap advertisers measure visitation lift and gather other location-related insights. Snap’s existing partnership with Foursquare, which has long powered Snap Geofilters, will continue.

This post was syndicated from Ad Exchanger.

More Stories

Go Media becomes Toitū net carbonzero certified

Under the Hood of Tesla’s Fleeting Foray Into Advertising

The Fin Tech Ad Tech Boom; Temu Tops Meta’s Charts (But At What Cost?)