By Sarah Sluis, Ryan Joe, Allison Schiff, Alison Weissbrot and Rae Paoletta

Programmatic is expanding, becoming a glossier way to transact and add value to both the buy and sell sides.

“We are moving rapidly into a programmatic-first world,” said Sal Candela, president of enterprise partnerships at Omnicom. “There is a surge of quality inventory in digital.”

As programmatic grows, what it means to be a top programmatic publisher has changed. Buyers value programmatic inventory as well as the complementary tech, data, creativity and service. And trust is paramount.

“Programmatic has expanded from yield management to automation and a change in how we liquidate relationships,” said Sarah Warner, digital investment lead for programmatic and video at GroupM.

Programmatic is finally catching on in TV, where it refers to anything that involves automation.

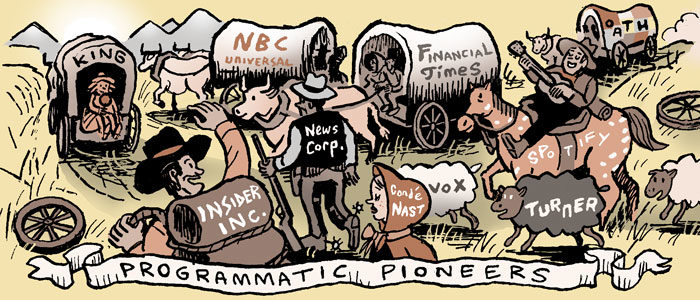

This year’s top programmatic publishers include longtime industry leaders who show to buyers their expertise in programmatic year after year. Others stepped on the gas in the past year in ways that made the industry take notice.

Here are the top programmatic publishers of 2018, listed in alphabetical order.

Conde Nast: Turning the page on programmatic

Programmatic is in vogue at Conde Nast.

In the past year, Conde Nast made all its digital products available programmatically. For the first time ever, sponsorships for the Met Gala sold to buyers transacting using programmatic guaranteed and private marketplaces.

Anything available via an IO can be bought programmatically, which had buyers – especially those seeking video inventory – singing Conde Nast’s praises.

The publisher is also building out Spire, a data platform designed to deliver better outcomes to buyers. The publisher claims advertisers who use the platform triple their return on ad spend. The publisher also acqui-hired to beef up Spire’s data science capabilities.

As advertisers consolidate spend with fewer, more quality partners, Conde Nast is making the case to capture those budgets, offering scale and data along with its high-gloss content.

“We’ve proved to the market that you actually can have it all,” said Evan Adlman, SVP of enterprise sales for Conde Nast.

Financial Times: Integrity in programmatic

Financial Times readers are smart and affluent and they pay for content. The FT shared its indignation publicly when it found that buyers on the open exchange were gobbling up $1.2 million of fake impressions each month.

The FT’s chief commercial officer, Jon Slade, sent a letter to clients warning them about the fake inventory.

“They have been very vocal in the marketplace about their supply being misrepresented,” GroupM’s Warner said.

When FT does sell programmatically, it tries to find ways for buyers to get more scale against its highly coveted niche audiences. Buyers bringing their own data can buy across the family of FT sites to gain scale. Others with reserved buys supplement them with private marketplaces.

FT requires a subscription and its registration data, which includes demographic and behavioral data, is coveted by buyers. Advertisers can access that data via direct deals and programmatic.

The publisher also has a commercial charter that emphasizes transparency around data use, reporting and pricing.

Insider Inc.: Verifying programmatic

In the past year, Insider Inc. – formerly Business Insider Inc. – led the charge against domain spoofing and became the first publisher to adopt Ads.txt, designed to eliminate impersonated inventory.

Its programmatic chief, Jana Meron, first did months of detective work to figure out why Business Insider saw only a fraction of the impressions from buyers who claimed to run video ads on the site.

In one case, an advertiser spent $40,000 to buy Business Insider on the open exchange, but BI.com saw just $97.

When Insider Inc. isn’t cleaning up the industry, it’s helping advertisers meet their goals. Its team of KPI hitters helps advertisers activate their own data as well as Insider Inc.’s audience data to supercharge campaign results.

Based on the team’s success driving results, many clients who started out programmatic-only have expanded into large-scale partnerships with Insider Inc. And a programmatic team of eight has increased revenue by 84% this year.

King: Where programmatic wears the crown

Programmatic is the name of the game for the creator of “Candy Crush.” The mega game publisher is wooing advertisers by making it as easy as possible to buy its inventory programmatically.

King checks the following boxes: It’s DSP agnostic, facilitates direct deals and offers third-party measurement along with brand-safe and viewable inventory for advertisers. And it’s constantly updating SDKs to meet the latest standards.

Buyers like King’s performance and pricing, plus the access to video inventory via rewarded video, which offers a clear value exchange between user and advertiser. Plus, because brands can use existing video assets, it’s more turnkey than bespoke gaming activations.

King is also working to clear up misconceptions about the value of game media, said Jonathan Stringfield, senior director and head of marketing, measurement and insights at Activision Blizzard Media, the newly formed advertising unit responsible for advertising within King games.

For example, some think gaming ads are intrusive and low-quality, when in fact users are known to be more receptive to brand messaging when they engage with rewarded experiences.

“In a world where digital advertising has increasingly breached trust among users,” Stringfield said, “we believe that transparency and respect for consumers is more important than ever.”

NBCUniversal: Ad tech wizards from the future

NBCUniversal is proof an old broadcaster can definitely learn new tricks and even outperform the pups. It just had to invest in the tech and talent to do so.

NBCUniversal created CFlight in April, an impression-based common measurement currency for video across TV and digital.

It also created an ecosystem that allows data to infuse buys across linear TV, video on demand, OTT, connected TV, short-form video, display and mobile, said Mike Rosen, NBCUniversal’s executive VP of advanced advertising and platform sales.

NBCUniversal places programmatic on a level playing field with direct sales, meaning buyers get the same access to inventory no matter how they buy it.

Buyers praised NBCUniversal’s progressiveness. With tons of video inventory and strong footholds in digital via partnerships and investments with companies like Apple News, BuzzFeed, Snapchat and Vox, they’re optimistic about what’s yet to come.

News Corp.: Poking the duopoly

What kind of data can take on the duopoly?

To answer that question, News Corp. created News IQ, which is loaded with first-party data advertisers can activate when buying across News Corp. sites as varied as The Wall Street Journal and Realtor.com.

Behind the scenes, News Corp. is using tools like Prebid to unify its inventory globally and assembling log-level data to better understand how advertisers value its audience, with plans to share that information with trading desks.

News Corp. is also an outspoken advocate for publishers as Google and Facebook grab more advertiser dollars despite facing brand safety and fake news challenges.

News Corp. CEO Robert Thomson recently called for Facebook to share more of the revenue that publishers generate for the social media platform.

It’s an attitude that permeates the organization.

“We believe in being activists to push the industry to always consider user rights, as well as creating a thriving ecosystem that supports premium journalism,” said Chris Guenther, global head of programmatic and SVP at News Corp. and an IAB board member.

Oath: The dark horse buyers love

Advertisers don’t seem to mind Oath’s “under renovations” sign as it goes through a lengthy tech integration.

It repeatedly came up in conversations as an incredibly powerful, highly scaled platform publisher with reach that’s hard to get anywhere else. The message? Don’t discount Oath.

The company’s owned-and-operated media properties and news search portals “represent scaled, direct publisher relationships I don’t see going away or slowing down,” Warner said.

Oath is still consolidating its many inventory sources to one buying platform, but it already has the scale to make up a large portion of big media buys. Plus, it offers targeting data pooled from Yahoo, AOL, Verizon and 1 million mobile apps.

AJ Kintner, Merkle M’s1 VP of business development, predicted Oath will offer a DSP with scale, reach and an addressable audience.

Oath’s excellent service also got points from buyers, who praised the insights its teams passed back in order to improve future campaigns.

Spotify: Programmatic audio OG

Spotify was the first digital audio platform to sell programmatic audio in early 2016. In 2017, programmatic sales grew 94% and now make up 20% of buys.

“Marketers are moving so much money to programmatic. We’ve seen that channel explode,” said Brian Benedik, global head of ads monetization at Spotify, in a previous AdExchanger interview.

Agencies like working with Spotify because of its strong service approach and wealth of data on music listening habits, which allows them to target moods and moments.

“They are innovative from a data strategy standpoint,” said GroupM’s Warner.

Spotify teaches its entire sales team to sell programmatically, even if their focus is direct. The company recently rolled out a self-serve platform in five markets.

“If it’s executed well, it will result in an important shift in the structure of the business, dramatically expanding margins,” Spotify CFO Barry McCarthy said on the company’s Q2 earnings call.

Turner: Plugging in programmatic

Turner, now part of AT&T’s WarnerMedia conglomerate, likes to be on the bleeding edge.

One of the first to create an audience-buying TV platform, it’s moved to get all the broadcast networks to rally around the OpenAP data standard. And each audience deal within Turner’s networks runs through OpenAP.

Turner is also trying to make OTT and connected TV more addressable by testing private marketplaces with buyers. The trust and dialogue Turner creates when testing new tech sets it apart, said Jon Mansell, SVP of marketplace innovation at Magna Global.

And Turner is working to simplify its tech stack. In the past year, it’s pared down its vendor list, doing more with selected partners.

Vox Media: The art of programmatic

Vox Media is blending scale, creative and quality content with its Concert ad marketplace.

In the past year, it opened up Concert to programmatic buyers and doubled the size of its programmatic team. But Vox Media encourages its buyers to use some of its bespoke creative units, which it says drive higher engagement than regular ad units and even Facebook ad units.

“We have been heavily pushing for a programmatic world that is not predicated on only 300x250s and 728x90s, but instead allows an element of creative flexibility,” said Ryan Pauley, head of Concert and VP of revenue operations.

Vox has also worked with DSPs and SSPs to execute custom ads programmatically.

The publisher added other outlets to Concert recently, including Quartz, PopSugar and Penske Media-owned sites like Variety.

“The bigger you are, the more you can matter,” Magna Global’s Mansell said.

“Publisher conglomerates could become cool again if they prove effective in pushing down technology fees.”

This post was syndicated from Ad Exchanger.