Although national broadcast networks have led the charge on audience data and automation – at least in the linear TV environment – local station groups aren’t far behind.

NBCUniversal Owned Television Stations is laying the foundation for greater addressability at the local and regional level. The division houses 39 NBC and Telemundo local TV stations in 24 markets, their associated sites and digital properties, a regional news network and a production company.

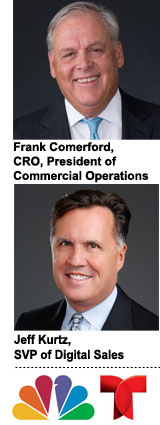

“Right now, inventory is addressable across our digital platforms, but we’re not far off from adding data and addressability to our television offering,” said Frank Comerford, CRO and president of commercial operations for NBCUniversal Owned Television Stations.

In the second half of 2017, NBC’s and Telemundo’s local station groups ramped up a data-driven audience strategy.

At the same time, Telemundo Station Group significantly enhanced support for cross-screen viewing last month by launching a TV Everywhere offering, as well as livestreaming across digital sites and apps via “Telemundo En Vivo.”

Comerford and Jeff Kurtz, SVP of digital sales for NBCUniversal Owned Television Stations, spoke with AdExchanger about how NBC and Telemundo’s network of local stations are refining their sales and distribution strategy as audiences become more addressable.

AdExchanger: How is your audience strategy unique, given NBC and Telemundo’s digital platforms are marketed collectively?

JEFF KURTZ: Because Telemundo station sites and apps and the NBC-owned station sites and apps operate from same backbone, we have a unique proposition to approach an advertiser and say we can run the same campaign in the right native tongue in either Spanish or English and provide a really dynamic offering, which we don’t think anyone else is in a position to do at scale.

On top of that, we can target much more than just age and gender with our assets with the Adobe data management platform.

How long have you been using a DMP?

Kurtz: It really became clear last year when you began to see a shift in the programmatic space. You started to see this recognition that the shotgun effect of spraying your brand across 5,000 sites wasn’t going to work for everyone. Because we’re a trusted publisher that consumer brands want to align with, we’re in a good position to bring [to bear] the kind of data marketers are looking for now.

We started using [the DMP] last year so we have that same access to data and information that the networks do, and in the back half of the last year we really started to accelerate.

FRANK COMERFORD: Going forward we will be even more focused on the integration of our television and digital properties so we can aggregate these viewers across English and Spanish, television and digital, traditional and digital MVPDs. … The impact of that [network effect] will be much stronger than the impact each of those businesses would have alone.

How does the live programming aspect change things from an audience and targetability standpoint?

Comerford: It’s complementary. If you look at the Olympics, our network was measuring what they call TAD – total audience delivery – which is taking people who watch on TV, streaming and other networks, and adding all those impressions together. One of the things local needs to do, which the network has already been doing, is to move away from the concept of ratings points and toward the concept of impressions.

That’s been the basis of programmatic, at least in digital, for some time. What does it take to translate that to the TV side?

Comerford: It’s technological. … We have talked with all of the big holding companies and are 100% committed to automating the process to reduce friction and to make it easier for our agency partners to work with us on a multiplatform basis.

What we have not been able to do is get the technology to work right. Nobody is fighting the idea of transacting on impressions or more automation. The idea of programmatic being a dash to the bottom or this commoditization of inventory is not something we’re looking to do. If it’s more about efficiency and automation and improving things for our customers, we’re in favor of it. It’s the way of the future, our customers want it and we want it.

What does NBC’s and Telemundo’s rights to the Olympics and forthcoming World Cup mean for local affiliates and advertisers?

Comerford: Our audience, while they’re Americans, have closer roots to their native country than the general population as a whole. The fact that the US team is not competing in the World Cup this time is disappointing for soccer or fútbol as a whole, but with Telemundo, every Spanish-speaking contingent is represented.

I think securing [exclusive Spanish-language broadcast] rights to the World Cup is a unique opportunity Telemundo’s never had before. Live sports is probably the No. 1 value proposition for local television, and nothing is as big as the Olympics or World Cup. It’s large, and it’s global.

A big trend we’re seeing at the network level is reduced commercial loads or this effort to improve ad formats. How are NBC and Telemundo stations thinking about adding more value or utility with formats?

Kurtz: Because we have our own creative studio in the ad sales org, we started creating responsive ad units last year before the IAB standards even changed, so it’s required a minimal adjustment on our end to completely adopt the new standards. That helps us create more optimized ads by device and give advertisers access to a dashboard where they can see which ads are performing the best.

From an opportunities standpoint, it’s capitalizing on the livestreaming events we have across NBC and Telemundo with the World Cup and our regional sports networks to do streaming throughout the year for sports. We’re building a digital program around that, which will be available in both English and Spanish where advertisers can do a multiproduct deal for an entire year with a contiguous storyline.

Comerford: We also have a group called Skycastle LX, which does production across all of our [local station businesses] in TV, web and digital. They create everything from five-second inserts to half-hour or hour-long programs.

Interview condensed for clarity and length.

This post was syndicated from Ad Exchanger.

More Stories

Three Seattle TV Anchors Make the Move to Radio

Thirst Trap Ahead: Progressive Says Drive Safely Around Calvin Klein’s Bad Bunny Billboards

People Are Surprised JCPenney Is Trendy. Its Comeback Ads Challenge That.