By Alison Weissbrot, Sarah Sluis and Kelly Liyakasa

Programmatic has transformed the role of the media agency.

When programmatic was new, trading desks formed within agencies and holding companies to incubate expertise. As the buying method matured and the trading desk business model came under scrutiny, clients demanded that talent be integrated with their account teams. And so programmatic was relocated to operating agencies.

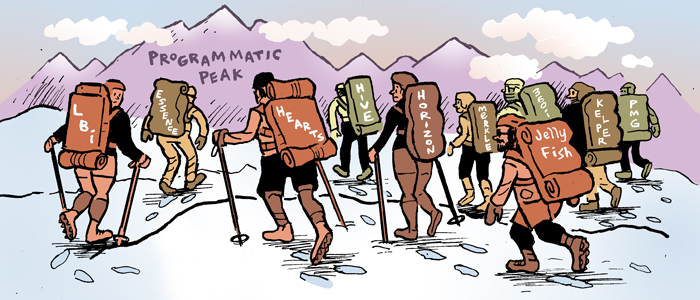

We’ve ranked the top 10 agencies advancing superior work in programmatic, based on the breadth of their services, their proprietary tools and their skills in applying data and technology to media buys.

Agencies on this list are agencies of record for brand clients. We did not consider managed service providers or trading desks for this ranking. That said, we recognize IPG’s Cadreon, WPP’s Xaxis, Omnicom’s Accuen, Publicis’ Precision and Dentsu’s Amnet have all developed and continue to provide essential programmatic expertise at the holding company level.

Here are AdExchanger’s top 10 programmatic agencies, ranked from 10th to first.

10) PMG: The Dev Agency

Despite its prowess in programmatic and tech, don’t mix up Texas-based indie agency PMG with a vendor. In fact, it’s the digital agency for J. Crew, Beats by Dre and Sephora.

“We’re very clear that we’re not an analytics or data science shop,” said Dustin Engel, who heads the data science group at PMG. “We’re a media agency with strategy, planning and execution. Everything comes back to that, whether it’s data, creative or analytics.”

Fifteen percent of the 150-person staff focuses on programmatic buying. And 20% are engineers that develop tools for programmatic buying.

One tool is the agency’s proprietary platform, AMP, which offers a hybrid onboarding, CRM match and campaign management and activation solution. AMP refreshes CRM files and daily to keep match rates up to date and uses machine learning to segment and activate audiences in real time.

9) DigitasLBi: The Unbundled Approach

When Publicis Groupe broke up its trading desk VivaKi in 2014, programmatic talent moved to digital agency DigitasLBi, where the discipline became a core focus.

When Publicis Groupe broke up its trading desk VivaKi in 2014, programmatic talent moved to digital agency DigitasLBi, where the discipline became a core focus.

The agency brought on Emily Macdonald, formerly director of global partnerships at Xaxis and a digital consultant at Ebiquity, as its first global head of programmatic last August. It has since grown its programmatic, media technology and data analyst teams fourfold to more than 100 employees and won Mattel’s digital and programmatic business.

According to programmatic lead Carol Chung, Digitas is working to defy traditional agency business models by moving away from the commonly used percentage of spend. Separating talent from technology helps clients understand what’s working and where to increase spend.

“Is it that the inventory was too expensive, or was it that the platform charged you a 20% fee?” Chung said in a previous AdExchanger interview. “When it’s all bundled together, it’s really hard to tell what’s working.”

8) Jellyfish: The Indie Google Experts

Jellyfish is a UK indie digital agency making its name as a programmatic leader in the US.

As a DoubleClick certified marketing partner and the only certified DoubleClick training partner and reseller, Jellyfish has deep ties to Google. It trains 4,000 advertisers, agencies and management consultancies on the DBM stack every year, including marketers from Nestle and Sesame Street.

But like most modern agencies, Jellyfish employees are trained to buy on the client’s preferred stack during the agency’s six-month Jellyfish Academy training program.

Jellyfish has also capitalized on the in-housing trend. For instance, it’s helping Lowe’s navigate tech and service providers to stand up a stack in-house.

“We do the research, come back with findings and help [clients] select partners for the future,” said Mario Schiappacasse, head of display at Jellyfish. “Certain pieces are a heavy tech evaluation, [like finding] the best access to third-party data for a type of transaction.”

7) MightyHive: The In-Houser

Independent programmatic agency MightyHive isn’t worried it will become obsolete if clients take programmatic in-house. In fact, it aims to enable the process – providing consulting, systems integration and overflow staff support.

The flexibility to help clients take control of their media spend won the agency Sprint’s digital AOR earlier this year, in which it will help the telco establish an in-house programmatic trading desk.

“Their deep expertise in programmatic and advisory capabilities make them a natural choice [for this account],” said Rob Roy, chief digital officer at Sprint, in a statement provided to AdExchanger.

MightyHive, which buys 100% of media programmatically and has all staff working on programmatic in some capacity, offers flexible engagements, staffing and fee structures to be able to work with clients at any point in their programmatic process.

6) Kepler Group: Automating More

An independent digital agency started by a MediaMath alum, Kepler Group has roots in programmatic.

An independent digital agency started by a MediaMath alum, Kepler Group has roots in programmatic.

All media buys run through the agency’s proprietary Kepler Intelligence Platform (KIP), which automates audience creation and optimization. By automating grunt work, KIP lets employees target more granularly and focus on strategy while bringing down costs for clients.

“They’re as close as you can get to what the future media agency will look like, which is far more consultative, flexible and based on core [technology] capabilities,” said Kepler client Robert Birge, CMO of Lola Travel and former CMO at Kayak, in a previous interview.

Kepler’s 150 employees take a 35-module training course and continued education spanning client relations, coding, ad ops and ad tech systems integration. Kepler buys programmatically for all clients, which include Fidelity, Dish and PayPal.

5) 360i: The Smart Bidder

360i is unique in how it integrates creative and media.

Born as a search agency, 360i launched an in-house programmatic team five years ago that’s since grown to 126 employees with a presence on every client account. The agency buys programmatic for 82% of its media clients.

Using custom machine-learning algorithms, 360i optimizes programmatic bids to drive lift against business KPIs. Different algorithms optimize to different KPIs, whether that’s user acquisition or sales.

By adjusting bids in real time against attributes like location, device type and time of day, 360i helps clients find efficiencies. And with creative in-house, 360i uses dynamic creative optimization and sequential messaging to personalize campaigns for individual consumers.

“Paid, owned and earned should be planned together,” 360i Chairman Bryan Wiener said in a previous interview with AdExchanger.

4) Horizon Media: Transparency First

Horizon Media gained status as the largest global independent media agency through a lot of sweat equity. Historically focused on TV, it rolled out a dedicated programmatic practice called Horizon HX in 2014.

While it was slower than its holding company rivals to the programmatic game, Horizon was deliberate about offering data and pricing transparency to clients – an approach that appears to be paying off. Overall revenues have grown more than 100% per year since the launch of HX, and retention rates both client-side and internally clock in at 90%. Today, Horizon buys programmatically in some capacity for all its digital clients.

“We’ll go as deep as the client wants to on how much this costs, how this data company collects this data, how much we’re making and why,” said Adam Heimlich, SVP of programmatic at Horizon, in a recent AdExchanger Talks podcast.

Today, about 40% of all digital media spend running through Horizon is programmatic and about 100 employees – or 15% of Horizon’s total employees – are programmatic experts.

3) Hearts & Science: Born Programmatic

Hearts & Science, the Omnicom agency  account, was built on the back of strong programmatic leadership. CEO Scott Hagedorn is the founder and former CEO of Annalect, the data platform underpinning Omnicom, and the agency recently brought on former Accuen CEO Megan Pagliuca as its chief data officer.

account, was built on the back of strong programmatic leadership. CEO Scott Hagedorn is the founder and former CEO of Annalect, the data platform underpinning Omnicom, and the agency recently brought on former Accuen CEO Megan Pagliuca as its chief data officer.

Beyond its brass, all 1,000 of Hearts’ employees, a handful of whom come from Annalect, touch programmatic across planning, activation or publisher and private marketplace relationships. Hearts buys programmatically against a proprietary audience graph that spans DSPs and walled gardens, as well as a SKU-level inventory graph that classifies historical data.

Hearts & Science assesses its clients’ abilities to use ad and marketing technologies and brings in its own experts to operate those tools where need be.

“Programmatic’s role has been very downstream,” Pagliuca told AdExchanger in September. “We’re taking it upstream, closer to the strategy and the brand. Targeting on a one-to-one basis is becoming a reality in digital.”

2) Merkle: Programmatic CRM

Traditionally a CRM agency, Merkle is applying its long expertise in first-party data to programmatic. After being acquired by Dentsu last year, it’s offering up its approach to a new network of sister agencies.

Traditionally a CRM agency, Merkle is applying its long expertise in first-party data to programmatic. After being acquired by Dentsu last year, it’s offering up its approach to a new network of sister agencies.

Marketers working with Dentsu agencies can match their own first-party data with Merkle’s addressable identity pool M1 to find and target customers.

Merkle activates 87% percent of media spend in programmatic channels, with traders trained on multiple platforms. The agency executes complex technical strategies, like retargeting shoppers from display to YouTube, or designing a pixel recency strategy that ensures retargeting bids are in balance with a shopper’s site history. Ninety-five percent of campaigns are managed in-house.

“While we may have traditionally been seen as a performance media shop, our future is as a leader in people-based marketing,” Chief Media Officer Coleen Kuehn said in a previous AdExchanger interview.

1) Essence: Truth in Metrics

Essence truly gets programmatic, going the extra mile to deliver on metrics that ensure its clients get value from their buys.

The agency is moving away from last-touch attribution to measure performance against metrics that  can’t be gamed, like its “qCPM,” or cost for every 1,000 quality impressions: viewable, on-target, brand-safe, in-geo and within acceptable frequency range. With regard to open exchange bids, it has built custom tools that ensure quality, like crawling Ads.txt files and checking where buys run at the log level.

can’t be gamed, like its “qCPM,” or cost for every 1,000 quality impressions: viewable, on-target, brand-safe, in-geo and within acceptable frequency range. With regard to open exchange bids, it has built custom tools that ensure quality, like crawling Ads.txt files and checking where buys run at the log level.

“The space has become commoditized to the point that audiences become numb to formats and placements, and the impressions are not impactful,” said Ryan Storrar, head of media activation in EMEA, in a previous AdExchanger interview. “We try to get a read on incrementality of what’s delivered. Programmatic is an impactful channel when done right.”

Essence is also Google’s digital AOR and the top investor in DoubleClick, YouTube and Google Display Network, but buyers are trained across all platforms.

To keep programmatic expertise strong, Essence puts every campaign into a “learnings library” analyzes every six months to determine the optimal frequency or channel mix for clients. Essence buys programmatic for all clients and employs experts across platforms.

This post was syndicated from Ad Exchanger.

More Stories

oOh!media backs YouthLine ‘Walk the Talk’ fundraiser

Air New Zealand wins March Kantar Ad Impact Award

Tegel gets heads bobbing with dentsu Aotearoa