The Trade Desk’s growth streak shows no sign of diminishing, with revenue of $477 million in 2018, a 55% increase from the year before, according to the company’s earnings report on Thursday.

The Trade Desk’s growth streak shows no sign of diminishing, with revenue of $477 million in 2018, a 55% increase from the year before, according to the company’s earnings report on Thursday.

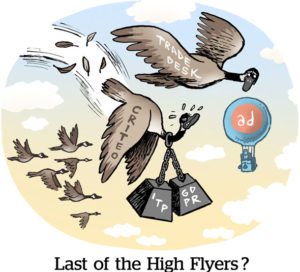

Shares of The Trade Desk were up more than 10% in after-hours trading. The company raised eyebrows last year when its stock went from a plateau of $50 per share to trading around $90 as GDPR went into effect. Following its earnings report, shares jumped to more than $165.

The Trade Desk forecasts revenue of at least $637 million in 2019. And the company laid out some of the emerging categories that will help it sustain high growth rates and justify a market cap growing above $7 billion.

Connected TV

After years of being the shiniest of shiny objects in programmatic, connected TV sales are now “measurably helping the business,” said Jeff Green, The Trade Desk’s founder and CEO. The company doesn’t break out its revenue by category, but Green said CTV sales grew more than nine times from 2017 to 2018 and a double-digit number of brands spent at least $1 million in 2018.

The fastest-growing inventory sources are large networks like Fox, NBC and ESPN adding direct-to-consumer channels, he said. But Hulu is the “tea leaf” company to watch for clues to what data-driven TV companies will do, since it has both an ad-supported tier and an ad-free subscription offering.

“Hulu makes more money on those users that request ads than those that pay not to,” Green said.

Many broadcasters and media companies will follow Hulu’s model, with an ad-supported tier and ad-free subscriptions, and when they do programmatic tech will prove its worth compared to traditional direct ad sales.

The runaway growth rate of CTV advertising will taper off moving forward, Green said, since the company “has already done so much land-grabbing in CTV.”

Identity

One of The Trade Desk’s long-term initiatives is its unified identity program.

The overabundance of cookie-based IDs – most ad tech companies have their own ID – slows down site pages. And when cookies don’t sync, it diminishes audience match rates and measurement, Green said.

The Trade Desk is trying to make its cookie pool a default option for programmatic companies. The initiative is popular with SSPs and data companies, many of which count The Trade Desk as a critical partner because it directs so much ad spend and has a much larger data marketplace than other DSPs.

He called Google’s plan to remove its ID, and Facebook reducing the use of third-party data, “an amazing gift.” Without the Google ID in particular, advertisers are losing wide swaths of campaign reporting data, and The Trade Desk hopes to seize customers reconsidering Google as a vendor.

Product updates

A new product suite The Trade Desk launched last year could also be a major growth driver.

The company’s predictive targeting tool, called Koa, and the new user interface helped increase cross-device campaigns by 300% in Q4 2018 and accelerated the growth of data sales on the platform above the growth of media.

Data marketplace revenue grew by 92% in Q4 2018 compared to 2017, Green said. And the number of data elements per impression is now at 2.5, doubling from a year ago.

The Koa product also “counteracts the effects of publishers’ moves to first-price auctions,” Green said. Switching to first-price bids drove up CPMs, but advertisers using Koa have seen a 20% reduction, since it bids based on the expected floor without overbidding like a traditional second-price auction.

This post was syndicated from Ad Exchanger.

More Stories

The Trade Desk’s OpenPass Adds Rewards As It Pursues Wider Adoption

NZME’s work recognised at INMA Global Media Awards

Leading Brand Transformation: A Masterclass With Doug Zarkin